PHOENIX — For nearly 40 years, every purchase made in Maricopa County added a little money to help pay for our infrastructure.

However, soon that money could dry up.

Earlier this month, Gov. Doug Ducey vetoed HB 2685, which would have allowed people in Maricopa County to decide if they wanted to extend a half-cent tax to help fund county transportation projects.

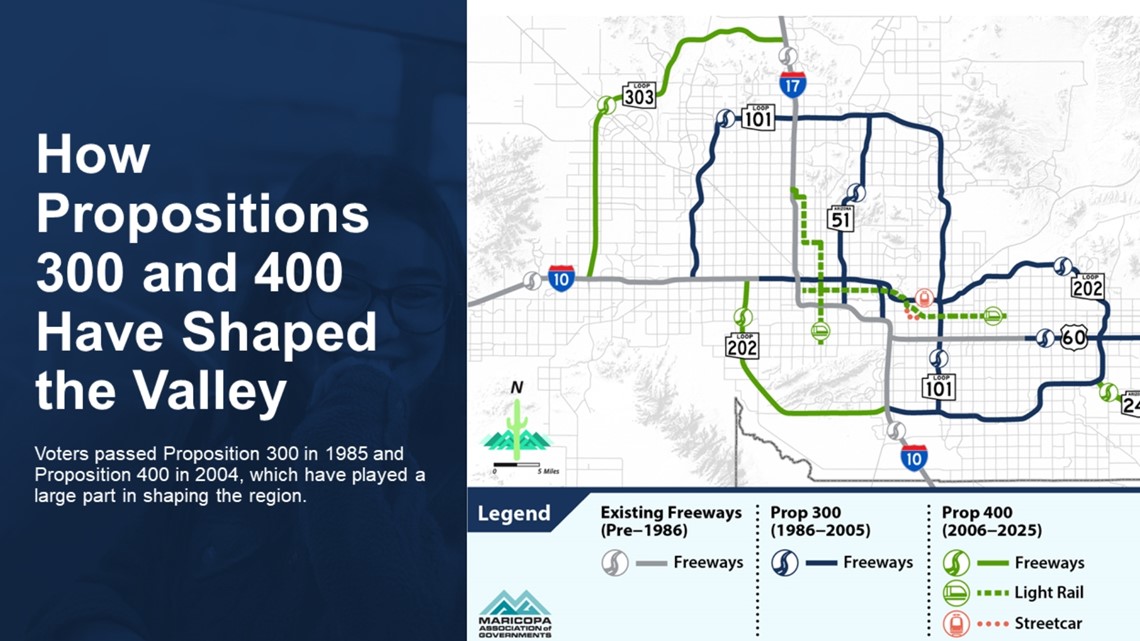

Proposition 300 first instituted a half-cent tax back in 1985. The tax was extended for another 20 years in 2004 with Proposition 400.

>> Live, local, breaking. Download the 12News app

The two propositions have helped fund the construction of Loops 101, 202, and 303. Money has also helped extend bus routes and the light rail system throughout the Phoenix Metro area.

"It made sense for everyone throughout the Valley," Avondale mayor Kenn Weise, the chairman of the Maricopa Association of Governments (MAG), said.

However, Prop 400 is set to expire at the end of 2024. MAG worked with lawmakers on both sides of the aisle to let voters decide on whether or not to extend the tax for 25 years.

"We are not talking about a new tax here," Weise said.

Under the current plan, the extension of the tax would bring in billions of dollars to improve Maricopa County's infrastructure. Including projects like:

- Around 360 miles of new highway

- $750 Million for road rehabilitation

- Around 180 miles of HOV lanes

- Additional bus transit

- Nearly 12 miles of light rail track.

RELATED: 'Went for a morning waddle': Ducks strolling on I-10 rescued by DPS

"We need these roadways. We need highway off ramps, we need mass transport," Weise said.

However, Ducey vetoed the legislation preventing the proposal from going before Arizona voters next Spring.

In his veto letter, Ducey laid out a myriad of reasons.

First, Ducey said because of record inflation, it was "not the time to ask Arizonans to tax themselves.”

Ducey claimed the proposal was not transparent nor responsible. In the letter, Ducey said the proposal's language was inflated, embellished, and failed to accurately reflect the tax burden on Arizonans.

Among other reasons, Ducey also said the plan was developed prior to the investment in infrastructure and jobs act and does not properly leverage state funds to pull down federal dollars.

“Voters are intelligent enough to look at the pros and cons and know if that’s what they want,” Weise said.

Weise said without extending the tax, pulling down federal money will get much harder.

The need for improvements is very real.

Maricopa County is one of the fastest-growing metropolitan areas in the United States. Weise said more expansion is needed in the state's highway system to keep pace with the growth.

Also, more than 50% of the county's highway system is older than its expected lifetime. Projections to replace the aging roads are between $1.6 and $3.2 billion.

So, what's next?

MAG will revisit its proposal to see if any improvements are needed.

However, Weise said they plan to try and get a similar proposal passed next year and have it on a ballot before the tax ends at the end of 2024.

Up to Speed

Catch up on the latest news and stories on the 12News YouTube channel. Subscribe today.