APACHE JUNCTION, Ariz. — Almond Brewer attempted to deposit a $3,200 check at the Pinal County Federal Credit Union in Apache Junction in October. While he was waiting, the bank manager called the police.

The check, the manager told the police, was fake. In fact, the bank would later admit that the authenticity of the check was "inconclusive." But the manager didn't tell police that when he called 911.

Brewer had just sold a boat to a woman on Facebook Marketplace. She paid with a check. His own bank suggested he take the check to the woman's bank to get faster access to the funds.

He said when he gave that information to the credit union teller, she “kind of looked surprised.”

The Pinal County Federal Credit Union told 12 News the bank manager called 911 after running Brewer’s check through a 3rd party verification system. The results came out inconclusive. The credit union also stated that the manager was able to get ahold of the customer who wrote and verified the check while officers were on their way.

But the police bodycam shows the officers weren't aware that the customer verified the check for about 10 minutes.

The moment has had a lasting impact on Brewer, a former college and professional basketball player.

“It was just, 'oh, you know, Black guy locks in his hair, tattoos came on a Harley, you know, let's assume the worst,'” Brewer said.

“Why embarrass somebody like that? Why, you know, make them feel less than a man,” Brewer asked.

RELATED: Lawsuit filed on behalf of Black realtor, clients who were detained at gunpoint during house showing

The Pinal County Federal Credit Union told 12 News the check had “red flags” such as an old credit union logo along with a routing and account number that didn’t match their member’s information.

Matthew Whitaker, the owner of Diamond Strategies LLC, trains financial institutions on how to avoid these situations, and said the bank should have called their customer before calling police.

"That person could’ve been called immediately before anyone called the police. So why escalate that at that point?" Whitaker said. "He [Brewer] was racially profiled."

“I haven’t been inside a bank since,” Brewer said.

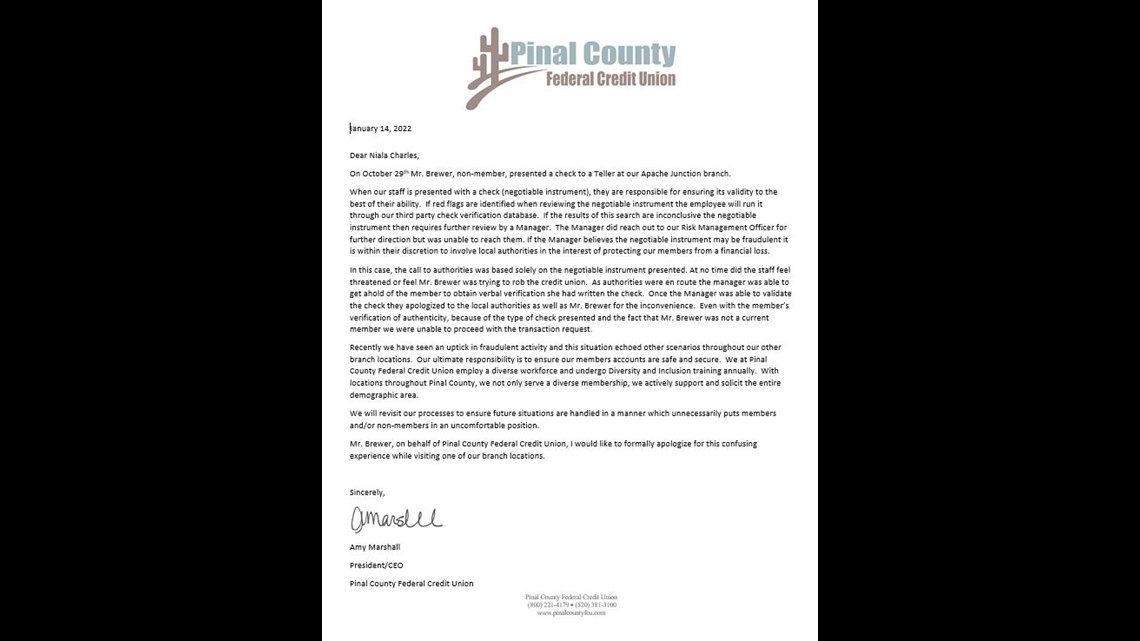

Below is the statement from Amy Marshall, the President/CEO of the Pinal County Federal Credit Union.

I-Team

Learn more about other 12 News investigations by subscribing to the 12 News YouTube channel and watching our I-Team playlist.