PHOENIX — You're not imagining it, auto insurance rates are in overdrive.

"I think auto insurance rates have reacted to inflation," said the Director of Strategic Communications at Insurance Information Institute, Janet Ruiz.

Rates began rising in 2021 and haven't slowed down since. As a result, many drivers are seeing a substantial increase in what they're paying and it's possible rates could go up even more.

The average annual rate increase in the United States is 8.4 percent. That's up more than 7 percent from 2022. In addition to inflation, Ruiz says prices are sky high because of many things like an increase in accidents, auto part shortages, labor shortages and auto thefts.

"So, all these things are putting pressure on the auto insurance companies and they have to raise rates," she said. "Basically, we take in the premiums so that we have enough money to pay out the claims."

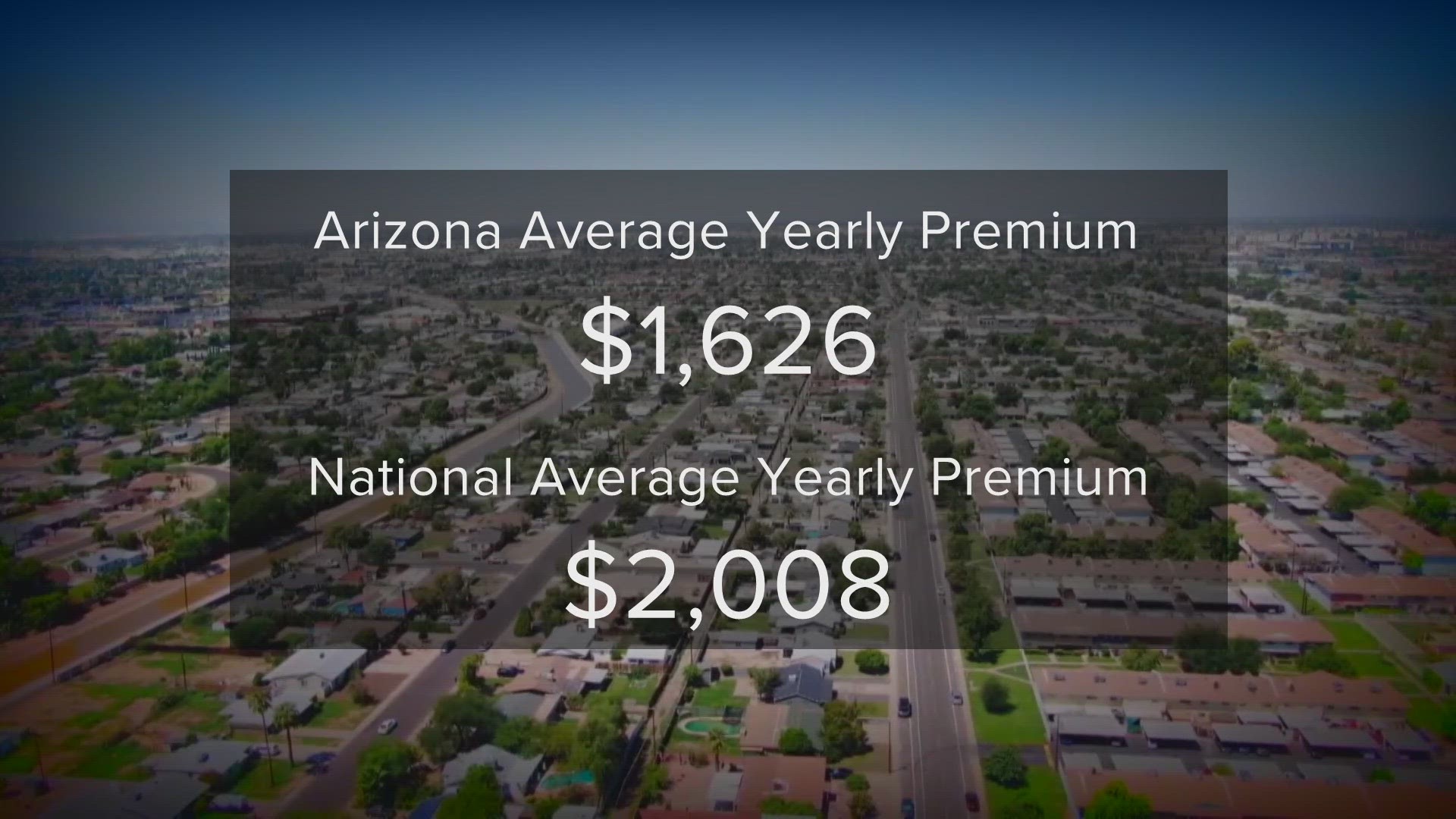

In Arizona, the average yearly premium is about $1,626 which is lower than the $2,008 national average. However, in larger cities in the state it can be much higher. For example, in Phoenix it's $2,019 per year.

One factor that can have a big impact on insurance costs is auto theft.

"That is also on the rise," Ruiz said. "The value of the cars is what they pay out. If we have a lot of valuable cars getting stolen, that will raise premiums across the board because we have to pay enough premium to pay for the losses."

The number of cars stolen began to increase during the pandemic. It has since continued to go up. In 2022, the 2004 Chevy Pickup was the most common vehicle to be stolen. More than 1,600 were reportedly stolen across the state.

"Better driving behavior can save you quite a bit of money," Ruiz said. "Younger drivers can use telematics devices, sometimes it's a mobile app or a device you plug into your car."

Ruiz says there are things you can do to take control of things, like talking with your provider.

"Find out what kind of discounts your insurance company offers, if you're not happy with your company you can always shop and compare. It's something you can manage so really take the time to look at your policy, your needs, your family and make some improvements that'll save you some money."

Rates aren't expected to reverse anytime soon which is why experts say it's best to kick things into gear now so maybe you don't pay as much later.