PHOENIX — Passing through the doorway of Melrose Pharmacy in uptown Phoenix feels like entering the 1950s. Its throwback decor harkens to another era.

But the pharmacy’s owner said she faces a distinctly modern challenge: pharmacy benefit managers.

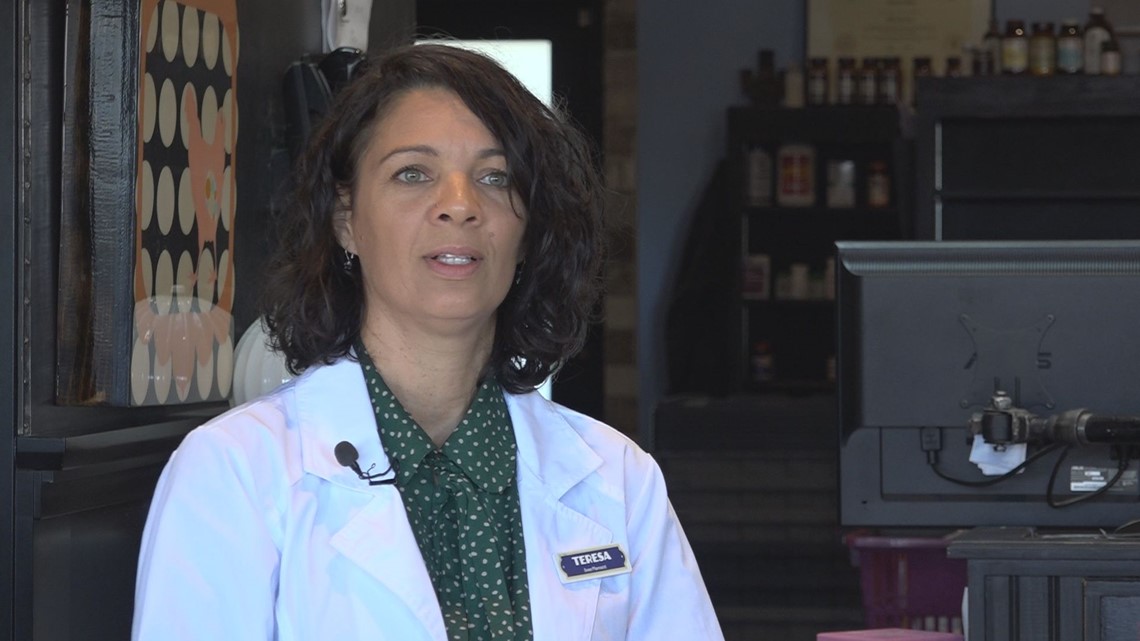

“I have been frustrated with PBM’s since the day I opened,” said pharmacist Teresa Dickinson. “Every year I say it can’t get worse. And every year it gets worse.”

“They are the mafia of health care”

Pharmacy Benefit Managers are third-party entities that negotiate drug prices with manufacturers and pharmacies, establish drug formularies and process drug claims.

They have increasingly tighter relationships with insurance companies and according to the nonprofit Brookings Institute, just three PBM firms serve 79% of the market. Those PBMs are also owned or co-owned by insurance companies, posing a potential conflict of interest.

Dickinson alleged that PBMs have too much unchecked power to dictate the price of prescriptions, where customers can go, and how much pharmacies get paid. As an independent pharmacy owner, Dickinson said she’s especially beholden to the policies of PBMs.

“They are the mafia of health care. They do what they want and no one can do anything about it,” Dickinson said.

Congressman Gallego Proposes Reform to PBMs

The nation’s largest PBM, CVS Health’s Caremark, said “PBMs deliver more than $1,000 in savings per patient” by leveraging their negotiating power against drug manufacturers.

“A world without PBMs would also mean lower-quality care, reduced access and more risk to customers across the health care system,” its website states.

But pressure is mounting in Washington D.C. for lawmakers to demand greater transparency and accountability from PBMs.

“By design, they were actually supposed to bring down the costs for consumers and at the end of the day what we have discovered is that it’s actually increasing the costs because they have a perverse incentive to sell the higher cost drugs at a higher rate,” said Arizona Congressman Ruben Gallego (D) of Phoenix.

Gallego recently proposed three bills to require transparency and scrutiny of PBMs.

One proposal requires them to annually report drug prices, financial arrangements they have with consultants and other inner workings of their business. Another bill provides an avenue for independent pharmacy owners like Dickinson to file complaints.

“Right now there’s nobody we can go to about these unfair contracts, nobody to talk to about how badly we’re being abused by these insurers,” Dickinson said.

Gallego’s third proposal would require HHS to gather information about “industry trends and the financial relationships between prescription drug plans and pharmacies.”

“We want to make sure that number one, the way PBM’s are pricing their drugs are based on real costs and not an inflated cost to create gross profits for their shareholders,” Gallego said.

PBMs run mail-order facilities, Dickinson alleges

Dickinson alleged that during her 18 years as a pharmacy owner, she’s watched PBMs grow in influence as they move into “different money-making schemes.” They now have financial ties with hospital groups, insurance companies, doctor’s offices, and the largest pharmacies. They also operate mail-order facilities that Dickinson said don’t save consumers money they are led to believe they are saving.

“People need to scrutinize what they pay in mail-order. They need to get their EOBs, their benefits sheet, and see what their plan is paying out for their medication,” Dickinson said. “You would think that mail-order is a cheap way to keep medication costs down but it actually is a revenue generator for the PBMs who own their own mail-order facilities.”

She said higher health insurance premiums indirectly pay for mail-order prescriptions and PBMs force mail-order services to their own pharmacies so they make the profits.

“I challenge people to bring me their EOBs and I will look at them specifically and tell you where the abuse is,” she said.

Pharmacy takes financial hits from PBM policies

PBMs also conduct audits of pharmacies that result in an abuse of power, Dickinson alleged.

“They absolutely go out of their way to try to take money back from pharmacies,” she said.

For example, one PBM changed its handbook and based on a technicality. Dickinson said she was required to reverse $70,000 worth of claims. If she didn’t comply, she said she would be cut out of the PBM’s contract.

In another case, Dickinson’s pharmacy filled a prescription for which a technician typed in the wrong pharmacist’s name.

“It re-filled several times and it resulted in $27,000 of take-back money they took from me because we put the wrong pharmacist’s name on the prescription,” Dickinson said.

A couple of years ago, she was forced to pay $300,000 in “Direct Remuneration Fees” from a PBM. Dickinson said she had no way to know the details of the fees and no recourse to appeal.

Dickinson: Independent pharmacies are especially vulnerable

According to Axios, one insurer, Blue Shield of California, announced in August it would no longer rely solely on CVS to serve as its PBM.

Dickinson said resentment against PBMs stems from their ability to dictate rebate plans and insurance policies.

“They make people pay for brand names and rebates that provide them kickbacks. The prices are not the lowest cost for the consumer,” Dickinson said.

Her pharmacy fills about 200 prescriptions each day and she barely “breaks even” financially.

“This is because I’m getting paid thousands of dollars below cost every month from insurers. I’m forced to take these ‘take it or leave it’ contracts in order to help my patients,” she said.

Dickinson has provided information to Gallego for several years. She supports the congressman’s bills because she said she believes they will force PBMs into “more fair contracts,” especially with the estimated 100 independent pharmacies in Arizona.

“The problem that independent pharmacies have is they don’t have the leverage of big pharmacies. They have to take whatever they can,” Gallego said.

Report: larger reforms needed

The Inflation Reduction Act took steps to reduce drug costs for seniors on Medicare. Gallego’s proposal represents a new effort to continue prescription drug reform.

According to a report by the Brookings Institute, legislation requiring greater transparency from PBMs could place greater pressure on them to be more competitive with each other. The report also concludes that while there are problems with PBM services, achieving “large reductions in prescription drug costs” will require “more fundamental market changes” beyond PBM reform.

>> Download the 12News app for the latest local breaking news straight to your phone.

12News on YouTube

Catch up on the latest news and stories on the 12News YouTube channel. Subscribe today.