SCOTTSDALE, Ariz. — The Scottsdale Unified School District must pay Maricopa County $27.5 million after a taxing error that wasn't the district's fault.

School districts and taxing districts across the county, including cities and fire districts, have all been ordered to pay, but no K-12 school district has to pay more than Scottsdale Unified.

The steep bill from Maricopa County comes after a class action lawsuit which the county lost.

Qasimyar v. Maricopa County

It started in 2016 in a case called Qasimyar v. Maricopa County. Property owners argued when their homes changed from an owner-occupied home to a rental or secondary home, or vice versa, that constituted a change-in-use. The Maricopa County Assessor's Office, run by Paul Petersen at the time, disagreed.

Property owners fought the decision in court and won. The court ruled they were taxed incorrectly and they, and others, were owed money back.

The county owes property owners $329 million so the county is now turning to taxing districts to help pay that money back.

Scottsdale governing board rejects plan to pay the county back

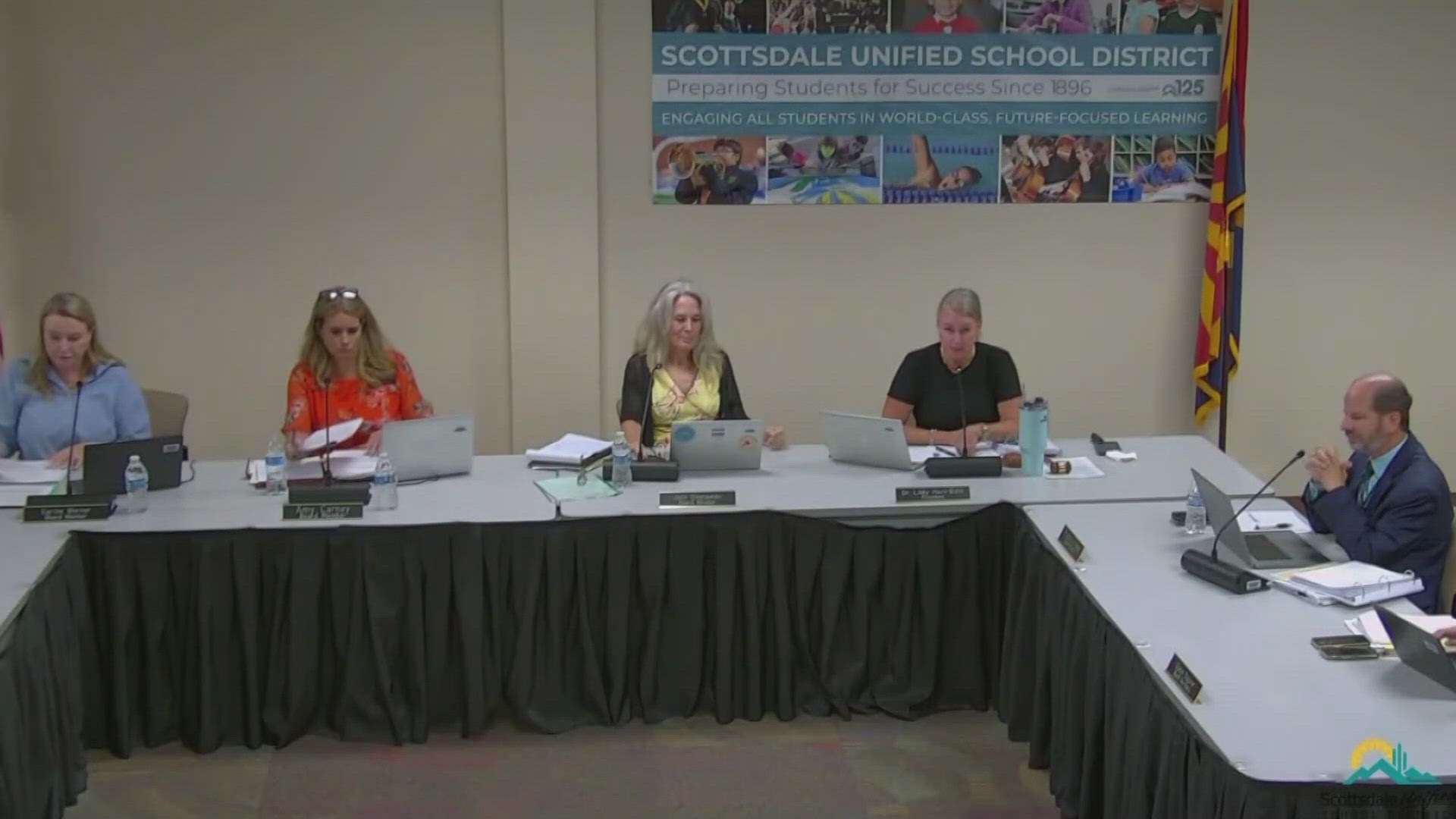

The Scottsdale Unified School District Governing Board discussed the looming payment during a meeting Tuesday.

The district's chief financial officer said they have about $10 million in excess cash, which is more than $15 million short of what they need. The governing board explored the idea of tax anticipation notes, or TANS, to cover the rest.

It would essentially operate as a loan from Maricopa County with a rate lower interest than the prime rate. Typically, it would be paid off in 13 months, but a recent change in state law would allow for the district to pay it off over four years if need be.

Erika Coombs of Piper Sandler is part of the district's financial advisor team. She said the county holds the district's funds as is. The county could start requesting payments as early as July and if the district has a negative balance, they hit a credit line.

"If they hit that credit line, they pay interest based on that amount and that's based on prime, which is over 8% right now. So this is a way for the district to have additional funds in their monies that are held by the county so that they don't have that extra interest expense," Coombs said of TANS.

The financial impact the plan would have on taxpayers is unknown.

Coombs said it wouldn't be clear until they determined the rate of the TANS. It would also depend on how long it took the district to pay it back.

The 2023-2024 SUSD tax rate was 3.38, according to a presentation at the board meeting. It's down from 3.65 in 2019-2020 and district advisors said any taxpayer impact would not come close to exceeding that.

The 2024-2025 tax rate is estimated to drop to 3.29.

Jim Giel, an attorney for the district, said he has asked the county for a breakdown of the $27 million the district owes to understand why the cost is so much higher compared to other districts, but he said the county has not provided that information.

“We believe it's because Scottsdale has a larger share of rental properties. And the issue came about because of a problem with the class 3 versus class 4 and properties shifting between single family and rental properties," said Jim Giel, an attorney with Gust Rosenfeld.

A spokesperson for the Maricopa County Treasurer's Office declined to comment.

Tense moments between board members over proposed solution

Board president Libby Hart-Wells and board member Julie Cieniawski supported the motion, while members Amy Carney and Carine Werner did not.

"I'm just not comfortable placing this burden on the taxpayer and I would like to see us come up with solutions to not impact our taxpayers," Carney said.

"Do you have a solution?" Hart-Wells asked.

"No, I said I'd like to see us come up with a solution," Carney said.

"But do you have one? They're the subject matter experts and they're telling us this is our solution right now," Hart-Wells said referring to Coombs and Giel.

The motion failed after a 2-2 vote.

"The district is now potentially risking not being able to pay its bills. Excellent," Hart-Wells said following the vote.

The meeting ended with no solution on the table and the next meeting not scheduled until August.

>> Download the 12News app for the latest local breaking news straight to your phone.

12News on YouTube

Catch up on the latest news and stories on our 12News YouTube playlist here.