PHOENIX — In our series New U November, we’re sharing the secrets to living your best life. On Today in AZ, we’re tackling what can be a sticky subject; money. Getting your financial advice off TikTok may not be the first thing that comes to mind, but you can find some useful advice.

Kelsa Dickey, a financial coach with Fiscal Fitness Phoenix, recommends establishing checking, savings and sinking accounts. But, there is no one size fits all number for how much money you should put aside.

"What is the floor for your checking account? In other words, you want to keep a certain amount in your checking account," Dickey explained. "That way, you never have to worry if I pay this bill a day early. Or if I overspend just a little bit at the grocery store. I don't have to worry about… my checking account and overdraft or how lean am I taking it?”

Next, sinking funds help you be proactive when it comes to known expenses like car maintenance, a medical bill, vacation or even kids’ activities. Dickey told 12 News, “The idea is to put money aside every single month. That way, you're not feeling that big hit all in that month. You're preparing for it ahead of time.”

Finally, an emergency fund for when life happens.

“So a pandemic… or job loss or a major medical expense that we aren't anticipating or aren't expecting," Dickey added. "That's what that emergency savings is for.”

Americans are drowning in a mountain of debt; car payments, student loans, credit cards, etc. TikTok users have plenty advice on mistakes you could be making in paying off those bills.

Dickey said pick one to focus on and pay the minimum on the others.

“There are some people who we say they pick the debt that just annoys them the most," she explained. "Every time they make that payment, they're like, ‘Oh, I regret that decision.’ There's sort of this emotional attachment to it. Well, we want to get that emotional baggage out of your life, right? So, we want to target that one first.”

Another mistake is making too many sacrifices all at once could actually lead you to regress.

“My goal is progress over perfection," Dickey said. "So as long as you're making progress towards your debt and you feel good about that progress, then add in the things that make you happy and make that journey of getting out of debt sustainable.”

So yes, you can splurge on that avocado toast once in a while. These tiny rewards can actually help you stay on track toward your financial goals.

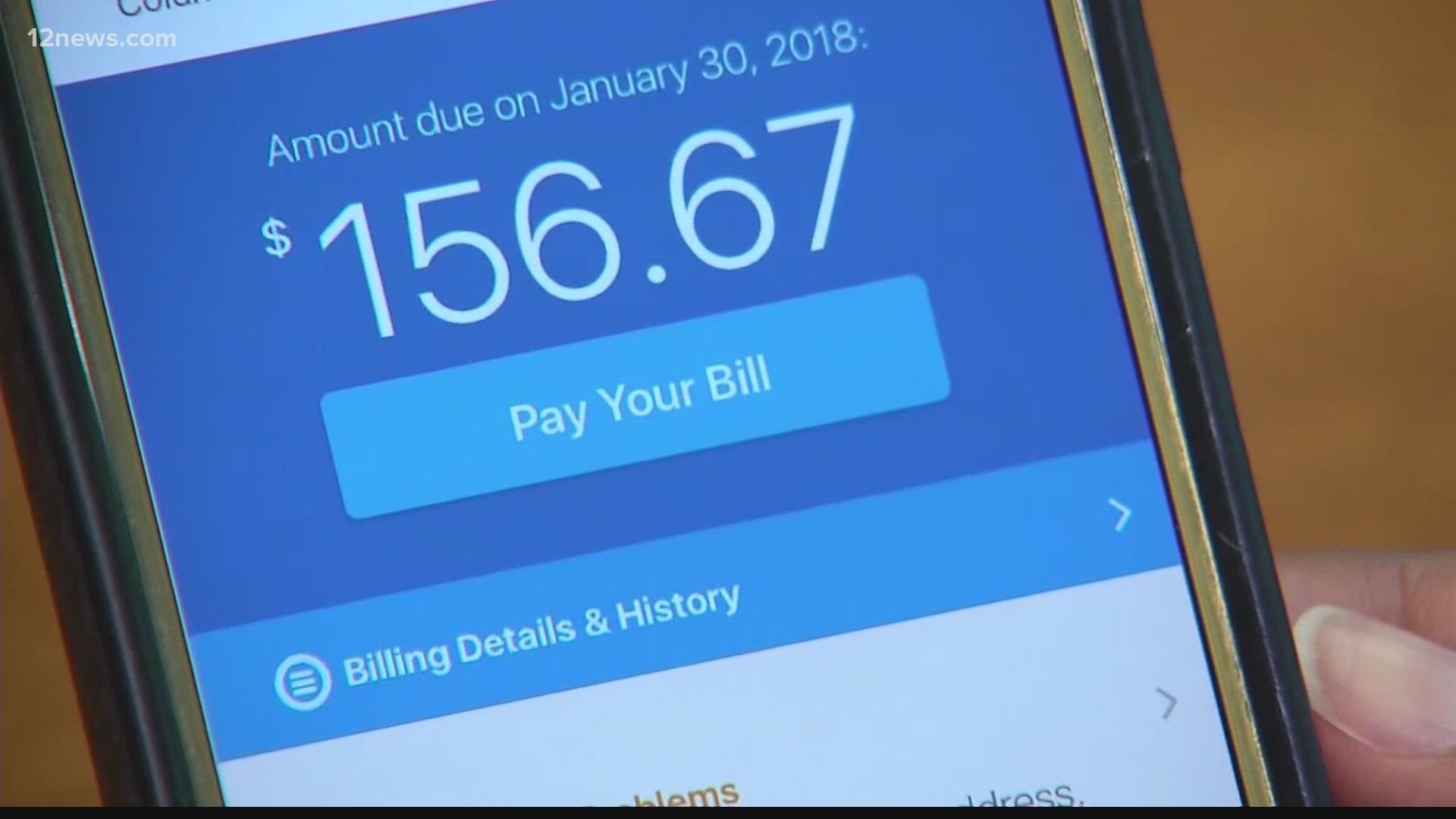

Money saving tips are quick to go viral online whether it’s cutting the cord or stashing pennies in a jar.

“Money is a very serious, tense thing, right," Dickey said. "So anytime you can add some playfulness to it, create a little game out of it in some way, it just helps to make it a little bit more fun and that's always a good thing.”

But, Dickey adds, don’t just nickel and dime your bills to save a couple bucks here and there.

“(While) I love the idea of saving two dollars on this bill or five dollars here, really the best place to start is looking at the big-ticket items," she explained. "So, if you're spending $600 a month on eating out… if we can cut that down by $200, that $200 is much more impactful than the five dollars on this one bill over here.”

You may have seen videos of people tucking a hundred dollars in an envelope at home or in a safe. Dickey said put it in a savings account where you’re earning interest. If it’s loose change, keep it where you can see it like a clear jar.

12 News on YouTube

Catch up on the latest news and stories on the 12 News YouTube channel. Subscribe today.