PHOENIX — For delivery driver Lorenzo Cruz, the driver’s seat is his office.

And these days, the office is a much more enjoyable place to work.

Cruz drives a slick new Toyota Hybrid van. Gone are the days of repairs, sputtering air conditioning and incessant gas runs that came with the old van.

“It’s been such an upgrade for us,” Cruz said. “I only have to fill up twice a week, sometimes only once.”

Helping Businesses Implement 'Sustainability Solutions'

Cruz’s boss owns Social Spin, an Arizona company that cleans and delivers laundry for businesses and homes across the Valley. Social Spin’s owner purchased the van with an extremely low 3% loan that was granted - in part - on her projected monthly savings in gas purchases.

“The loan opportunity presented itself at the perfect time,” said Christy Moore.

Yes, it’s just a van. But sustainability advocates believe the new ride represents the future.

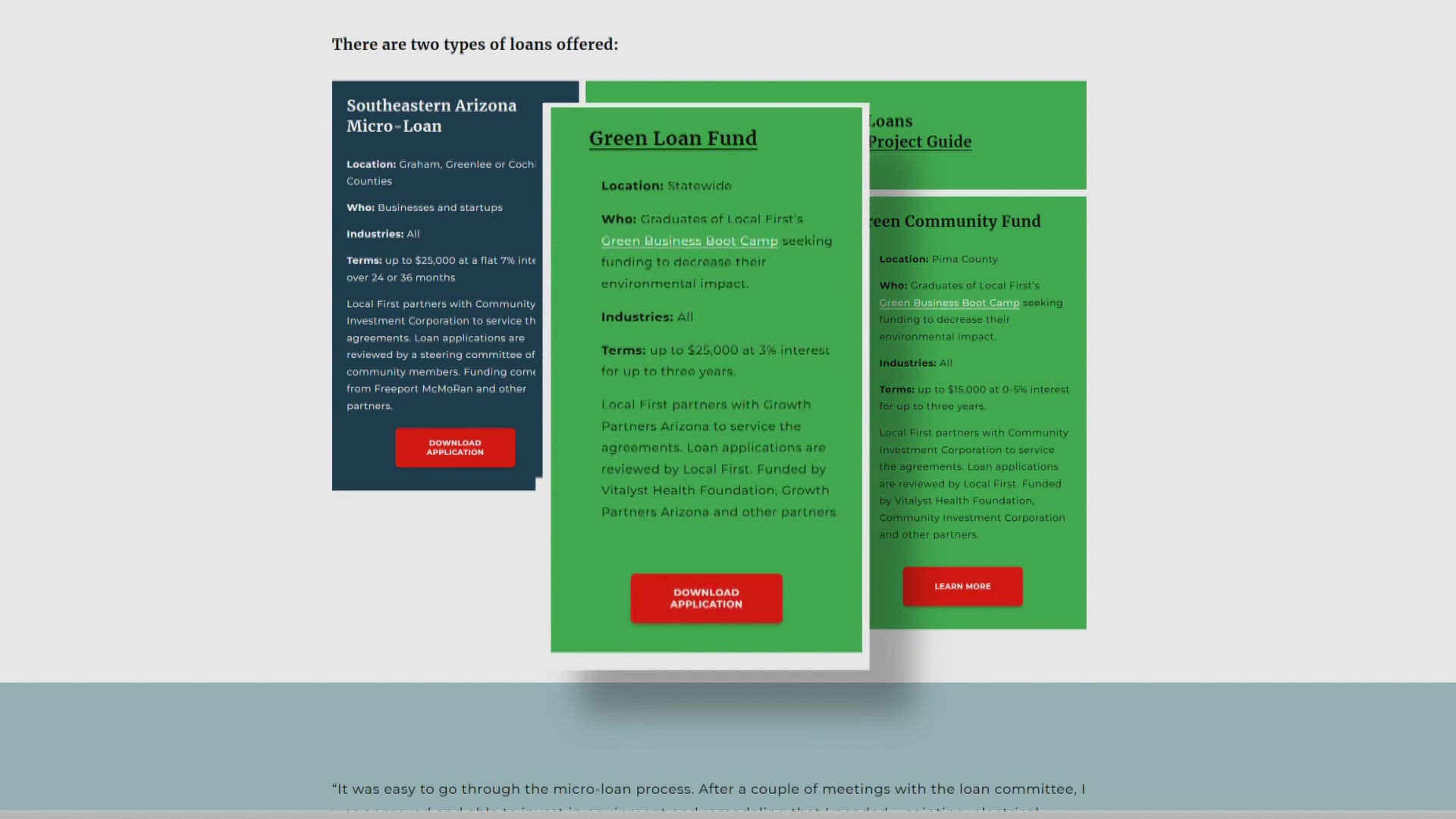

“The van is a reflection of how we are able to work with businesses to implement a sustainability solution,” said Jason Lowry of Local First Arizona. The nonprofit teaches business owners how to develop sustainability goals and how to apply for the Green Loan Fund, a small business loan program worth up to $25,000 to help businesses with sustainability upgrades.

'A crucial turning point'

In addition to the Green Loan Fund, the U.S. Small Business Administration is set to expand its existing loan program to include a climate and sustainability initiative this month. Sustainability-based microloans will be more accessible than ever before.

“Some of the lenders that we’re working with are getting their materials ready to really push this harder,” said Cristian Mendoza of the SBA Office of Capital Access. “We really feel this is a critical turning point in the small business economy.”

The SBA program guarantees a certain percentage of the loans to private investors, who work with nonprofits like Local First Arizona to facilitate loans. Arizona financial firms in the business of green microloans include Coalition for Green Capitol, Groundswell Capitol, and Growth Partners.

Mendoza said these kinds of loans will help businesses be less vulnerable to drought and rising energy costs.

“There are different loans that are widely available as a homeowner, that aren’t necessarily available to small businesses. We’re really trying to make sure they get to participate in the shift of the country’s economy to be more sustainable,” Mendoza said. “Maybe you don't want to be 100% electric in a week, but if something breaks, you need to replace it, we will be there to support you doing that.”

'Character Loans' Are More Accessible for Businesses

Examples of how green microloans are used include:

- Geothermal heat pumps for heating and cooling

- Appliances that minimize water and energy consumption

- New plumbing

- Rain catchment systems

- EV cars and trucks

- Solar panels

The 3% interest on the loan offered through Local First Arizona is a fraction of what banks offer businesses in similar circumstances, Lowry said.

“For locally-owned businesses getting a loan can feel like a herculean task. And the Green Loan Fund is a totally new way to do loans.”

They are not based on the usual metrics like credit history. Businesses can qualify by participating in the Green Boot Camp seminars. Four participating businesses have taken low-interest loans, and four more are in the process of getting loans. Mendoza said it is a “savings-based loan” that is not dependent strictly on a company’s financial portfolio and collateral. Instead the borrower pays back the loan using savings gained from the benefits reaped by the sustainable purchase. It is also a “character loan,” which relies on the borrower’s reputation and goals.

“We’re not going to ask you for three years of tax returns. Instead, we are going to ask you to go through one of our programs. In the program we get to know you,” Lowry said. “We know as a business owner you are in the business of doing good and we want to help you.”

Saving on Costs While Reducing Carbon Footprint

Doing good is a focus of Social Spin.

As a social worker who wears an entrepreneur’s hat, Moore runs both the business and a nonprofit overseen by a community board. Their goal is to support unsheltered people who need to clean their clothes.

“We see the downtime of a laundry mat as an opportunity to connect customers with care,” Moore said. The foundation’s downtown facility gives away food, haircuts and laundry services to men and women several days a week.

Moore said participating in the Green Boot Camp not only qualified her for the van loan, but it taught her how to alter deliver laundry routes to save time and gas.

Now she can do more “good” while saving money.

“They’re (drivers) driving less time on the road which has created 40 hours more a week for us to focus on laundry, and do laundry for free,” Moore said.