PHOENIX — Intel Corp., one of the Arizona's largest employers, will cut employees' compensation across the board as the chipmaker weathers steep declines in its business and braces for a tough year ahead.

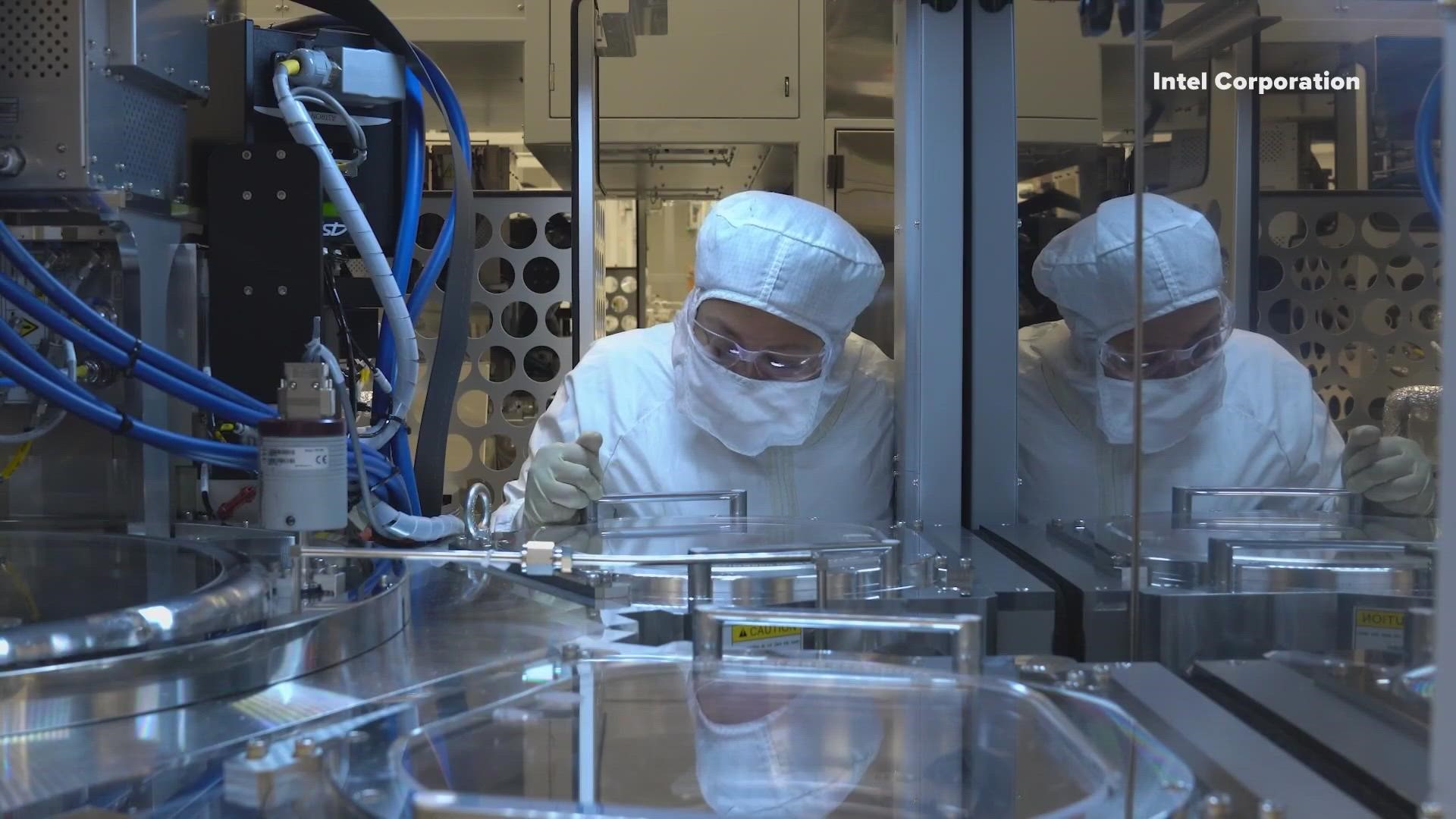

The company's 12,000 Arizona employees, concentrated at its Chandler semiconductor factories, face these cutbacks:

- 5% pay cuts for employees above midlevel ranks, which include engineers earning more than $100,000 a year, and 10% cuts for vice presidents. The pay cuts are effective March 1.

- No merit raises for any employees.

- The company's 401(k) match for employees is cut in half, from 5% to 2.5%.

- The executive leadership team will see 15% salary cutbacks.

Chief Executive Officer Pat Gelsinger will see his base pay cut by 25%, to about $315,000. But most of his compensation comes in the form of stock awards and options. Gelsinger's total compensation in 2021 - his first year on the job - was $179 million.

While the company has avoided the mass layoffs announced recently by other tech firms, there have been reports of selective layoffs at Intel sites.

A spokeswoman in Chandler declined to disclose how many employees have been laid off in Arizona.

Intel provided this statement:

"As we continue to navigate macro-economic headwinds and work to reduce costs across the company, we've made several adjustments to our 2023 employee compensation and rewards programs. These changes are designed to impact our executive population more significantly and will help support the investments and overall workforce needed to accelerate our transformation and achieve our long-term strategy."

In a semiconductor industry notorious for its ups and downs, this downturn for Intel could last a while. Intel's Gelsinger says the company's projecting its worst losses in 30 years.

Intel and other chipmakers are dealing with a slowdown in consumer demand and other challenges. But Intel's challenges are more acute.

Intel's revenue is in a freefall - down 32 percent in the last three months of 2022 versus the year before, and projected to plunge 40 percent through March.

Intel warned last week that it expects "persistent economic headwinds through at least the first half of 2023." Gelsinger said last week that Intel is "projecting losses that we haven't seen for 30 years."

Intel stock is trading at an eight-year low after a 42 percent nosedive last year.

Semiconductors are the brains of virtually every consumer device, from cell phones to cars. A significant portion of Intel's business is in data servers, which store, process and secure vast amounts of data.

Arizona's semiconductor industry, born more than 40 years ago with Intel's first Chandler plant, got a big boost last year with Congress' passage of the CHIPS and Science Act.

The law provides $39 billion in incentives to build manufacturing plants. The goal is to bring more semiconductor plants back to the United States to avert the supply-chain crunches that afflicted chipmakers during the pandemic.

Analysts project that Intel will be the largest recipient of those incentives.

While Intel struggles, an industry rival is establishing a significant footprint in the company's backyard.

Taiwan Semiconductor Manufacturing Co., a major contract manufacturer of chips, is investing $40 billion in two chipmaking plants in north Phoenix.

President Joe Biden traveled to Phoenix in December to mark the TSMC investment.

It's the largest private-sector investment in Arizona history, surpassing only Intel's two years ago. Intel broke ground on a planned $20 billion investment on two new chip factories in Chandler.

Latest Arizona news

Catch up on the latest news and stories on our 12News YouTube playlist here.