PHOENIX — Editor's note: This story was initially published on April 21, when the funding was first signed into law. The Paycheck Protection Program and Health Care Enhancement Act extends extends funding for the PPP.

Hundreds of billions of dollars in aid are expected to be coming for small businesses across the U.S. after the Senate passed a new round of stimulus funding Tuesday.

Included in the package is $310 billion to replenish the exhausted Paycheck Protection Program. The bill is headed to the House on Thursday, and President Donald Trump intends on signing it into law soon after that.

With billions of incoming funds, the program may seem flush with cash, but the initial round of money provided through the CARES Act lasted just 13 days.

So, what should small business owners do?

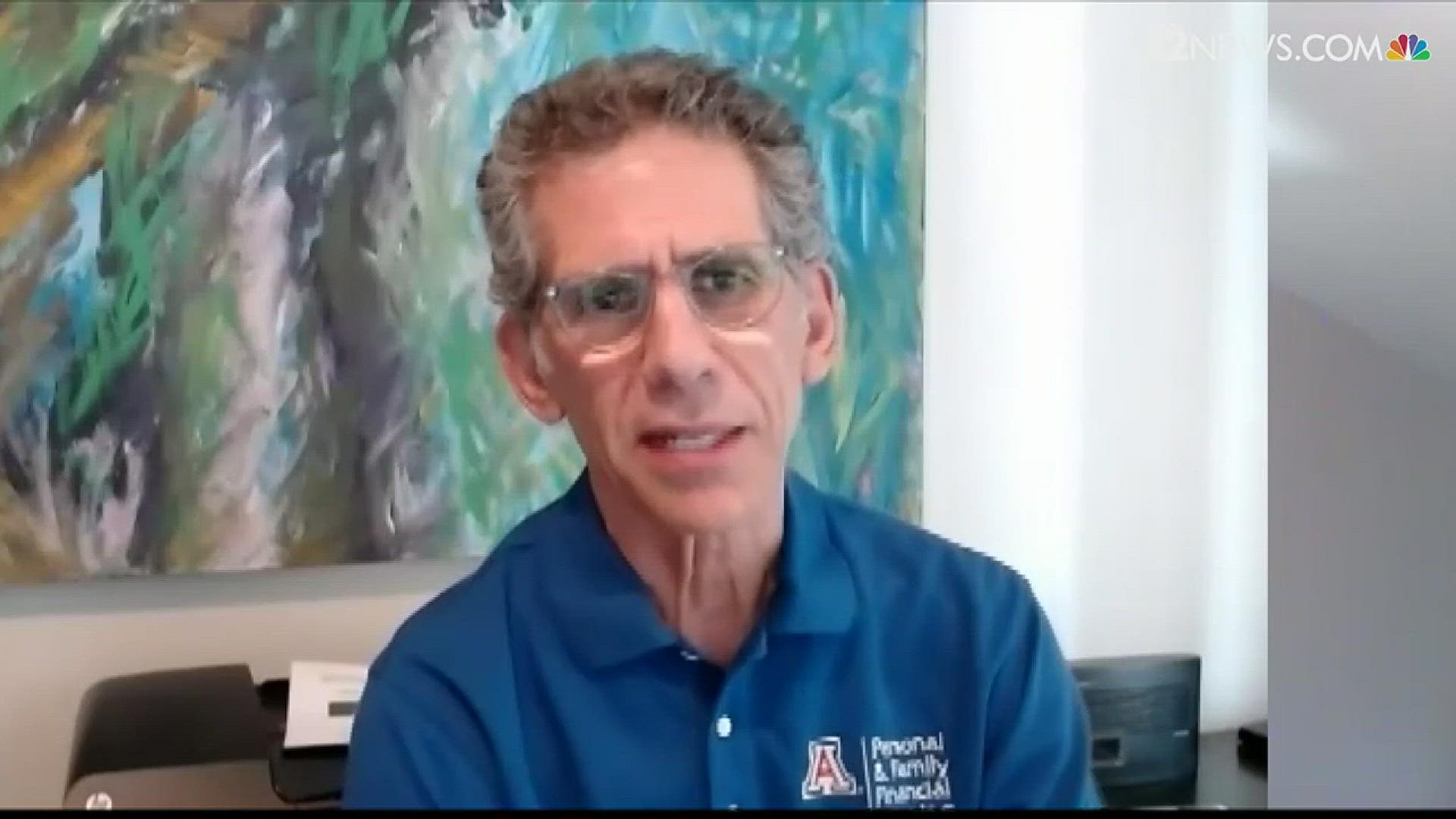

Tom Wheelwright, a CPA and CEO of WealthAbility, says you shouldn’t wait for the bill to pass to act now.

“Don't waste time,” Wheelwright said. “The $350 billion ran out fast the first time, and I’m not at all convinced that $310 billion is enough to cover everybody else.”

Getting your financial documents in order now is crucial in getting approved for the loan as quickly as possible.

“Most importantly is your average monthly payroll,” Wheelwright explained. “You need to have things like your utilities and your rent, know what those are because the bank's going to ask you for this information.”

“Get all the information together, meet with your CPA, get their help, and then get in front of a bank - that's the most important thing, get in front of a bank as soon as possible.”

Some small business owners told 12 News that they weren’t able to secure a PPP loan during the first stimulus package, but Wheelwright says there’s a better chance to get through with your bank this time around.

“What happened was that the big banks went to their prime customers, like the big franchises, and they ran out of money,” he explained. “The hope is that these banks now have some money. But clients that been working with the smaller local banks have had much more success.”

“If you have a small local bank or regional bank, I would get on the phone with somebody right now and see if maybe you could make a deposit in their bank or set up an account somehow to get started.”

The loan program is meant to help businesses keep employees on the payroll while relieving operating costs like rent and utilities for two months. So, if a business is approved for the loan, most of the funds must be directed towards employee pay.

“The fact is 75% of the money needs to go to payroll. So, you can hire employees back. You can even give employees a bonus, but you can't take money out yourself,” Wheelwright said.

“It's eight weeks from when you get the money, so as soon as you get the money, you got eight weeks to spend it. And you really ought to be considering how you are going to properly spend that money during that eight-week period to meet all the rules so that you don't owe money at the end of the eight weeks.”

While the PPP loan is the most heavily funded relief program, Wheelwright says there are other programs business owners should explore such as the Emergency Injury Defense Loan or SBA Express Loans.

But what’s needed to get any help is going to your bank with the required financial documents.

“There are other loans available to help the small business but, again, you have to get your information together, and you need to get in front of a banker and you need to do it now.”

Even if the COVID-19 pandemic eases in the coming months, the economic damage will be much longer-lasting. And Wheelwright says establishing a relationship with a bank or CPA is crucial in finding all the available resources to help your business survive.

“Most business owners don't really pay that much attention to them except when they're in a crisis. Well, now we're in a crisis,” he explained. “It's time to get that team together and make sure that you're helping your team members.”

See the full video interview with Tom Wheelwright above for more financial advice.