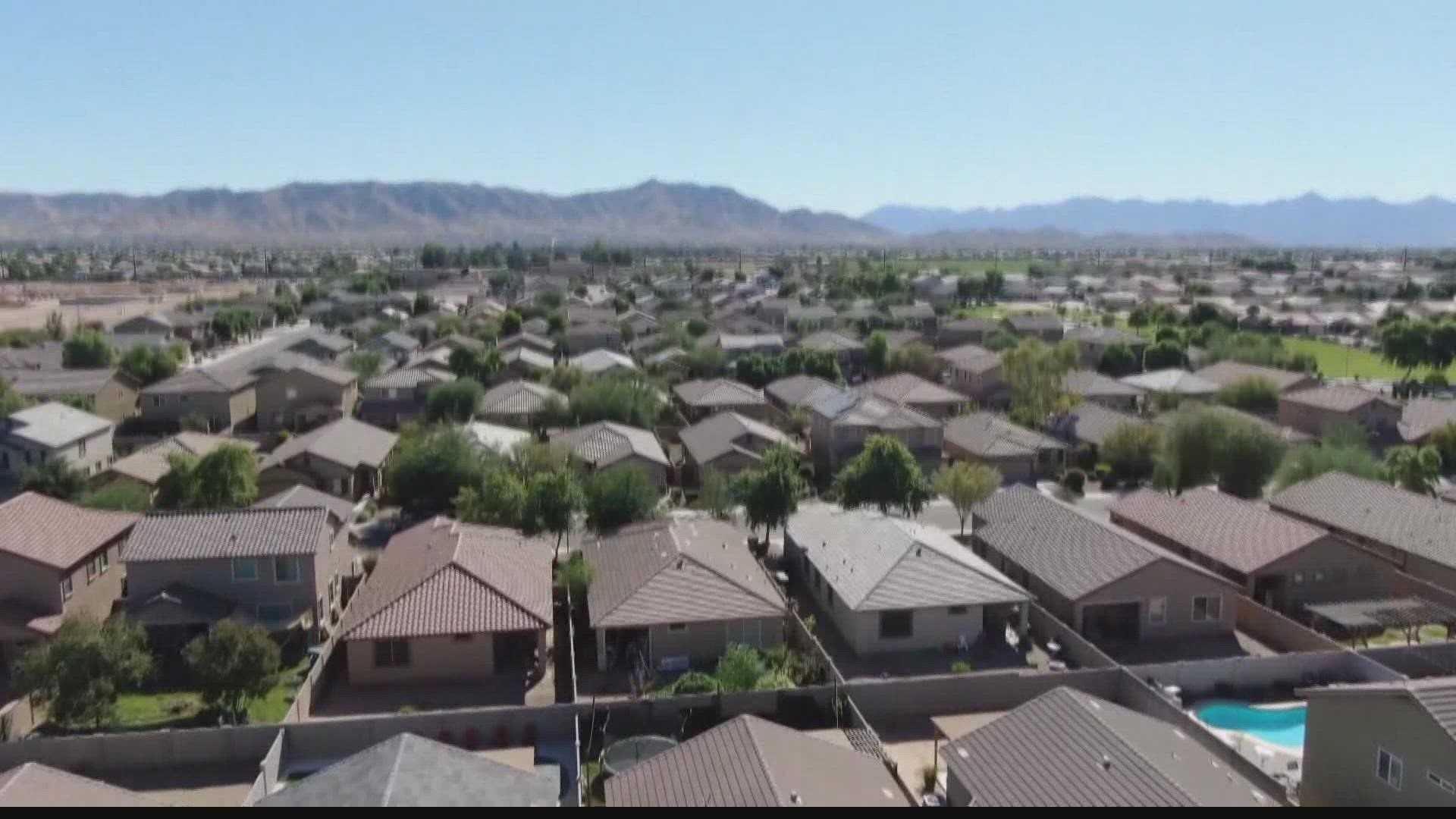

ARIZONA, USA — Higher interest rates are causing Arizona’s housing market to tap the brakes. That’s having all kinds of ripple effects among buyers and sellers.

Mortgage lenders and real estate experts agree we are in an adjustment period. Here are four changes we’re seeing right now.

Mortgage rates are up

Rates for a 30-year mortgage were as low as 2.7% in December of 2020. They were just above 3% at the beginning of this year and are now around 5.5% and above.

“Depending on the person’s situation, one, two, or three points could mean a large chunk for buying power of what they can get approved for by a lender, and what they can actually afford,” said Kelly Schmidt, Executive Sales Agent with the Jason Mitchell Group in Scottsdale.

Another real estate agent with 20 years of experience selling homes in the Valley says we’re “in an adjustment period.”

“Everyone is pulling back a little bit,” said Kelly Hall with Desert Gateway Realty. “Can people afford it with the increase in interest rates? That’s the question they will have to be honest with.”

Inventory is up

In the last couple of years there was an average of 3,500-4,500 homes on the market in the Valley in a given time period, Schmidt said. That number is now around 17,000, quadruple the amount.

The market is still competitive but there are signs of a slowdown.

“I have a friend who has a listing he put up in Peoria that hasn’t gotten a peep in one week, which six months ago was unheard of,” Schmidt said.

The increase in inventory comes as new home construction continues at a strong pace. In May there were 5,312 new private housing building permits issued, according to the University of Arizona’s Economic and Business Research Center.

Prices have slowed down

As expected, increased interest rates and lighter demand mean home prices aren’t going up as quickly.

“Home prices have not tanked by any means,” Schmidt said. “We’re still in a seller’s market to a certain degree. We’re not even at a balanced inventory yet, within Arizona.”

According to NBC News, higher mortgage rates and surging inflation are prompting Americans to cancel deals to buy homes at the highest rate since the start of the COVID pandemic.

Buyers have more leverage

Schmidt said buyers have more negotiating room on a house and aren’t beholden to sellers as they were six weeks ago.

“I’m able to negotiate deals now,” Schmidt said. “Before we were waiving repairs, waiving inspections. We were doing all these ridiculous things.”

Even with the recent dramatic increases, mortgage rates are still considered historically favorable.

Schmidt said he adheres to the motto, “marry your house, date your mortgage.” In other words, prospective home buyers who have the flexibility to buy at current interest rates will have the option to refinance in the future if interest rates go back down.

Up to Speed

Catch up on the latest news and stories on the 12 News YouTube channel. Subscribe today.